Destination Country and Outback NSW (DNCO)

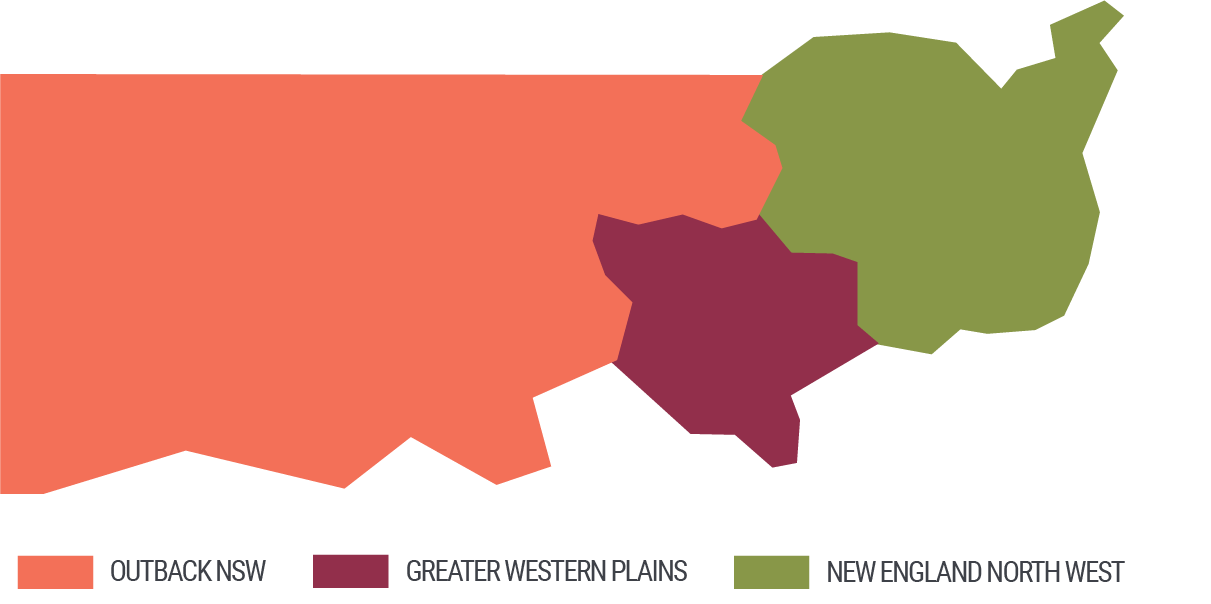

The region is vast, covering more than 40% of NSW and incorporating 25 local government areas as well as the Unincorporated Far West Region. It offers an amazing array of landscapes, experiences, and attractions for people to enjoy, whether they are visiting for work or holiday. Our research is designed to reflect this diversity by focusing in on three primary sub-regions or hubs: Outback NSW, Great Western Plains, and New England North West. Find out more about Destination Country and Outback NSW via this link… Destination Country and Outback NSW.

QUICK FIND

TRAVELLERS' PULSE 2024

FAST FACTS 2024

RESEARCH REPORTS 2024

GLOBAL AND DOMESTIC TRENDS IN TRAVEL

THE CUSTOMER JOURNEY FRAMEWORK

DNCO’S TRAVELLERS' PULSE 2024

Designing the right research methodology has been a critical stage in the development of the DNCO research project. In 2024 there have been a few changes to the research stages. This year there has been a review of the local and global travel trends, an online traveller forum, visitor data as well as accommodation occupancy rates to uncover a deeper, richer understanding of visitors to the whole Network Area – and each of the three network hubs.

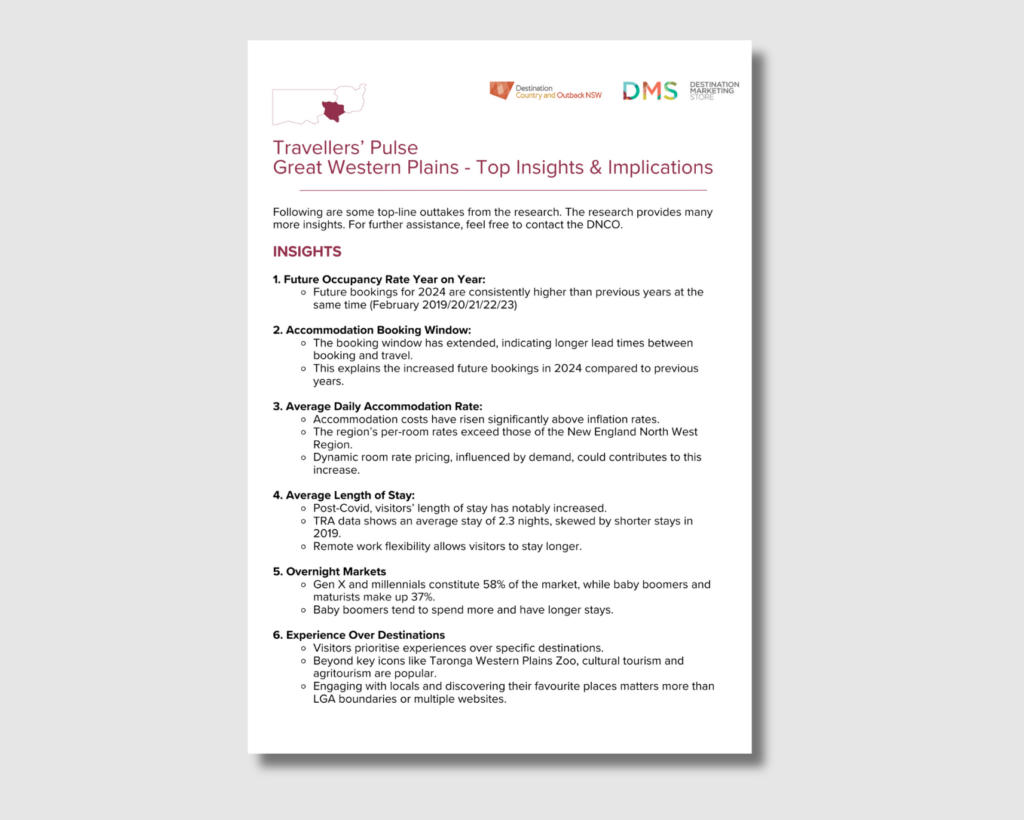

We have used Tourism Research Australia (TRA) data to establish the Fast Facts for each hub, providing baseline statistics that allow each region to compare 2024 data with 2023. Another stage of the research has been an online forum with 24 participants from different demographics and stages of life who have all travelled to the region. This research provides qualitative insights into various markets’ motivations to travel. The participants were asked in-depth questions about the importance of experiences over just looking for destinations when travelling to the broader region. In 2024 we have partnered with Localis who have provided a snapshot of actual accommodation bookings including forward bookings, booking window average length of stay and average accommodation rate.

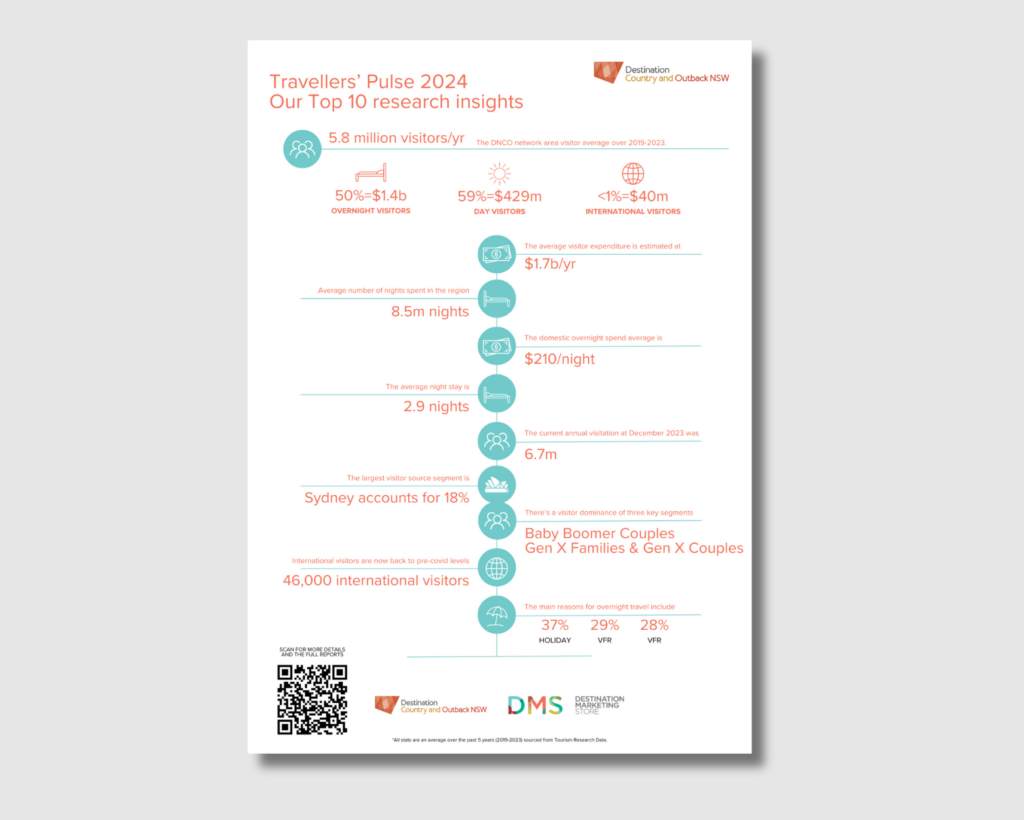

DNCO’S FAST FACTS 2024

DNCO’S RESEARCH REPORTS 2024

Tourism research statistics and the findings from the online traveller forums have been used create the below reports.

It should be noted that the Visitor Research Insights and Online Traveller Forums were created in the context of Destination Country and Outback region as a whole.

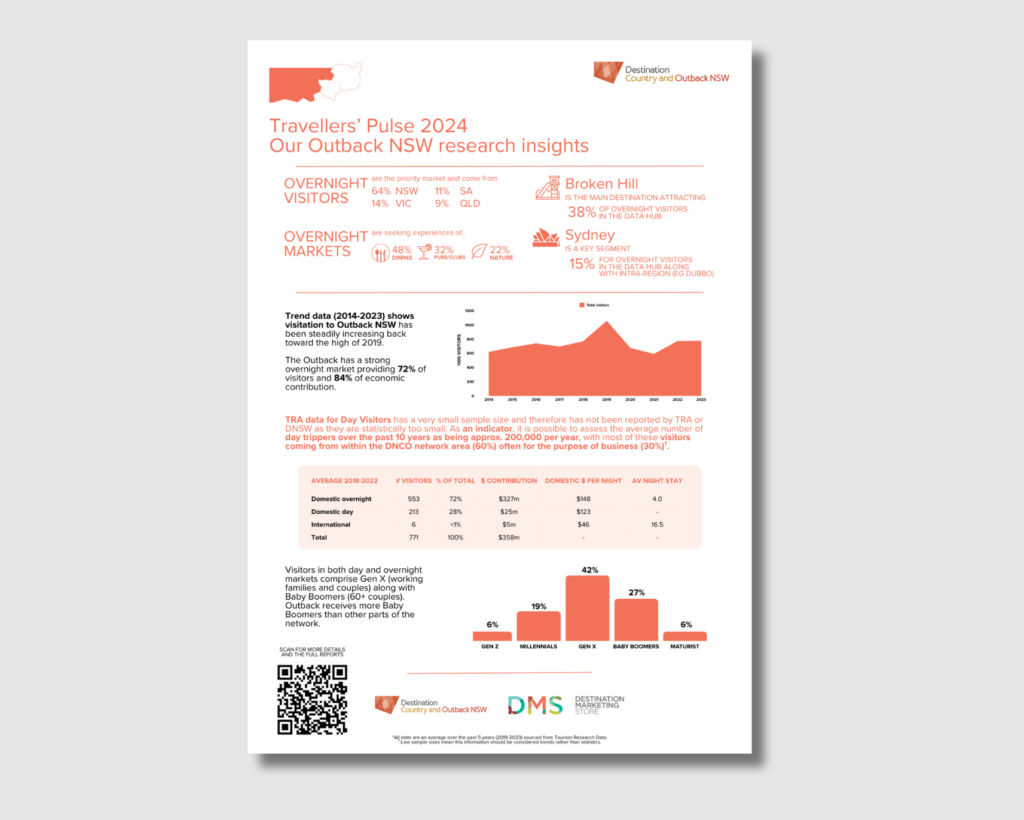

OUTBACK NSW

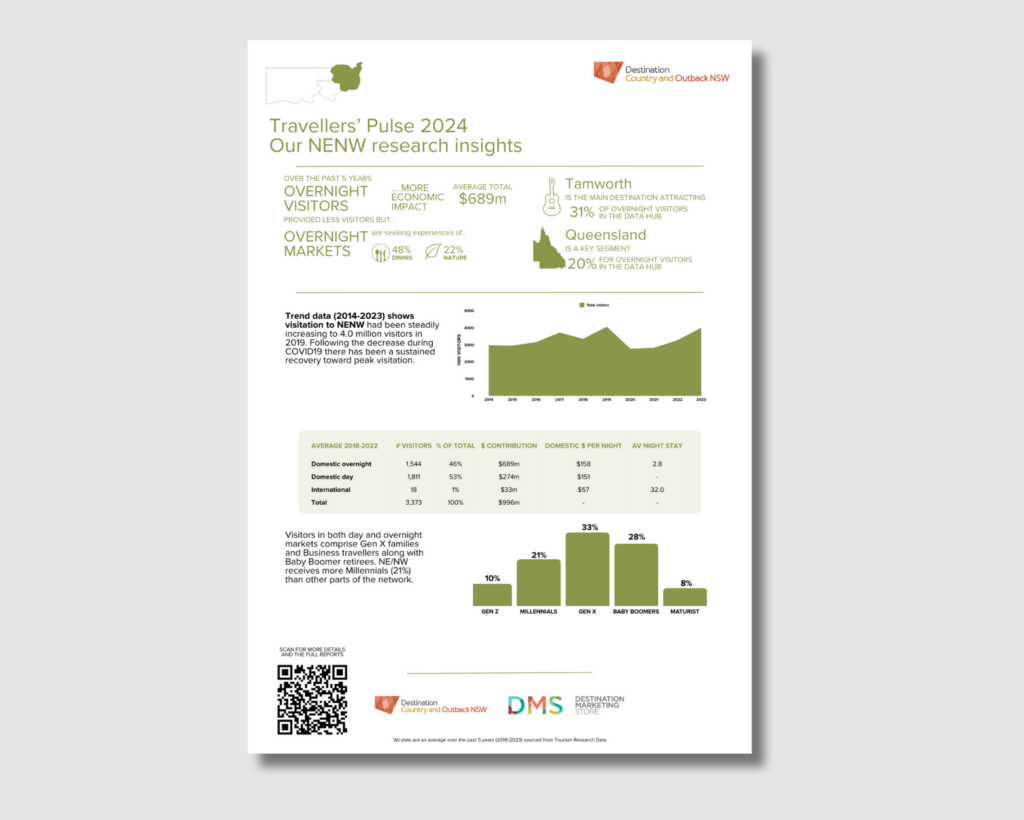

NEW ENGLAND NORTH WEST

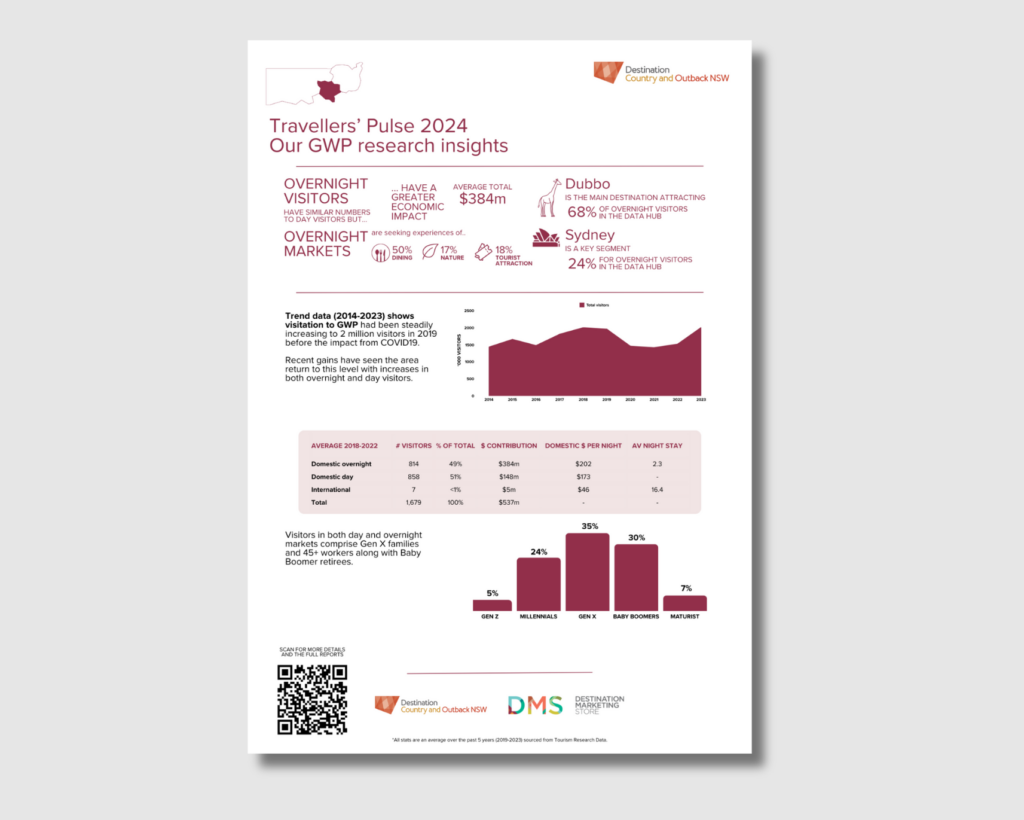

GREAT WESTERN PLAINS

GLOBAL AND DOMESTIC TRENDS IN TRAVEL

An understanding of consumer preferences, motivations and barriers to travel is essential to inform a visitor-centric and future-focused approach to destination management and marketing. This is informed by global and domestic trends in tourism and travel.

The insights in our attached report have been drawn from a wide range of sources, including SKIFT Research, Euromonitor International, Booking.com, Tourism Australia’s Future of Global Tourism Demand, Twenty31 (now Skift Advisory), Deloitte Access Economics, American Express Travel, and the Adventure Travel Trade Association, among many others. Many of these trends have been evolving and strengthening over several years, in some cases accelerated or amplified by the socio-economic impacts of COVID-19.

The Destination Country and Outback NSW Destination Management Plan 2022 – 2030 (February 2023) highlights the most relevant trends in travel and tourism for the broader region (see page 15).

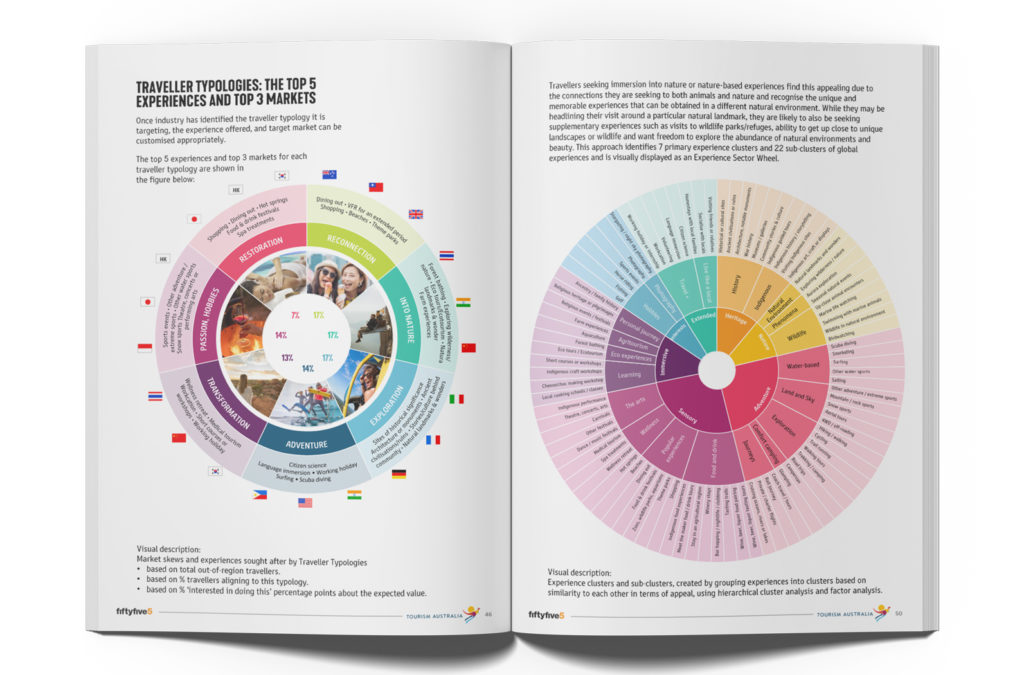

Tourism Australia (TA) has undertaken a comprehensive research project, Future of Global Tourism Demand (November 2022). It adopts an experiential approach and examines motivations and desires of relevant traveller segments relevant to Australia.

There are two areas of interest that assist us in understanding visitors to regional Australia as well as international travellers:

- The Typology of Visitors seeks to categorise the motivations of visitors or ‘what they want’ from their holidays. TA identified 7 main motivations – this is a useful reference point for us to think about the main types of visitor motivations (page 42)

- The second area to consider is how visitors categorise their own experiences and the suite of experiences they are interested in. TA identified 7 main experience clusters, along with over 300 individual experiences (page 50)

See the full report here: https://www.tourism.australia.com/content/dam/digital/corporate/documents/future-of-demand/tourism-australia-global-future-of-tourism-demand-research-public-report.pdf

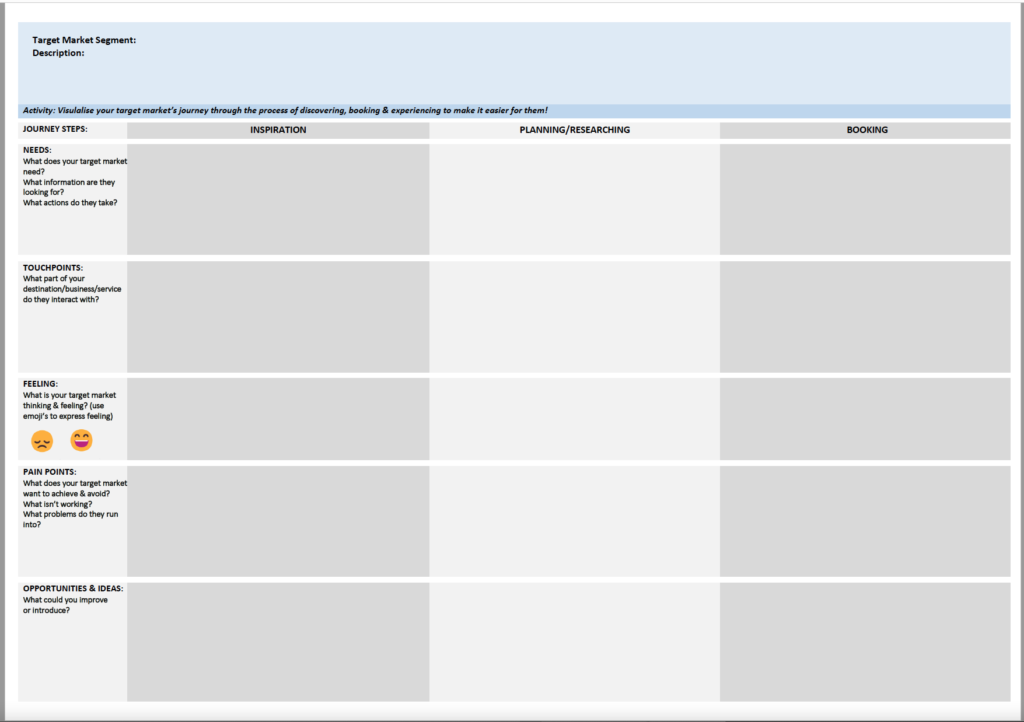

THE CUSTOMER JOURNEY FRAMEWORK

Practical insights into using the research

The customer journey is about identifying and optimising all the touch points that a customer or visitor has with your destination or business, from dreaming about their next trip (inspiration) through to booking (conversion), planning (information) and sharing their experience with family and friends (word of mouth advocacy).

We’ve outlined below some key considerations when mapping the customer journey of your target markets.

A critical consideration is understanding what people are looking for at each stage.

- Is it inspiration or more detailed planning information?

- Is it convenience that comes with online booking?

- Is it content, such as videos and images, that they can share with their friends and family to invite them too or simply boast about what a great place your destination is to visit?

Best practice in mapping the customer journey should start with knowing who your target markets are as well as understanding their pain points at each touch point. This means you can better target your efforts to reach and inspire them to visit your destination. And make it easier for them to keep them coming back, stay longer or even spend more.

A high level overview of some key considerations in the customer journey.

Create a customer journey for your target market: download our customer journey map.

The 7 key areas of the customer journey and what they mean for you.

Walk in their shoes for a moment (target market personas can help with this) – think about their desires, expectations, and barriers to travel. From the customer’s perspective, they want you to communicate with them in a way that resonates with their motivations; not just to read everything about all your attributes. Remember, people make decisions with both their hearts and minds!

It seems obvious but too often we forget to be focused on our audience or target markets. If they like surfing or theme parks, then Country and Outback NSW is not for them. Don’t waste valuable resources trying to be everything to everybody. Unpack motivations by market segment. For example, a Generation X Family is wanting a different experience than a Baby Boomer couple, even down to the best time of year or week to travel.

Newspapers have been doing this for a long time – they start with a headline (inspiration) and then provide more detailed information for those who are interested in reading more. Adopt this approach by separating the stages of communication. What will work to inspire people in an era of the attention economy, where you need to stand out among the crowd. When it comes to trip planning, have you thought about all the things that will make their preparations easier? Don’t try and do all the heavy lifting in the same channel – in today’s world, a multichannel approach is critical for promotion, visitor servicing and advocacy.

One of the most unloved parts of the customer journey sits between when people book the main things, such as airfares or accommodation and when they arrive in-destination. However, this period is exactly when they are starting to plan their trip. They need useful information, such as the ideal itinerary, what’s on (events and tours), making bookings for popular restaurants, which tracks, trails or roads are open, through to practical tips on the weather and what to pack. This is a job for both the destination as well as local businesses and accommodation providers.

We know from Tourism Research Australia (TRA) research that over 92% of visitors to a region do not visit the Visitor Information Centre – we need to make sure they’re receiving the right information too. Recent Google Research found that 85% of leisure travellers decide on activities only after having arrived at the destination – this represents a huge opportunity to increase yield or length of stay by encourage them to book before they arrive! However, we also need to be better prepared to share information on what to do while in the region. Striking a balance between tours and guided activities with attractions and free or self-guided activities is paramount.

Sometimes the little things make a big difference. Whether its information for planning their experience or a little something that value adds to their enjoyment. The more you surprise and delight, the more likely people are to recommend you to their friends and family. Think of the Tiny Nice Things (TNT) you can do or provide for your customers to keep them coming back.

Advocacy drives your marketing spend well beyond your budget. If your visitors have a great experience at each touch point along the customer journey, they will tell their friends and family all about it. It’s called word of mouth advocacy and it’s the greatest friend of any destination or business. Look for ways to help your customers or visitors to share their positive experiences and engage with them in a positive and constructive way if they provide feedback. Advocacy helps you to reach more people who are more likely to be in your target markets.

Our visitor insights are drawn from two primary sources

ONLINE TRAVELLER FORUMS

We conduct online forums with travellers to discover more about their experiences and obstacles when travelling in regional Australia. We select participants based on their fit with the target markets for the region as well as for their interest in travel to these or similar destinations.

LOCALIS

We use specialist location analytics software, Localis, to provide unparalleled insights, execution and measurement. This software allows us to bridge the divide between tourism data and actionable insights.

These insights are then combined to explore and explain the behaviours of travellers who have visited your region. In essence it is the who, how and why of traveller behaviour. You will also discover findings corresponding to the new Future of Global Tourism Demand research undertaken by Tourism Australia (released in November 2022).

Meet our Research Strategist: Dr Jo Mackellar

Dr Jo Mackellar, our Research Strategist, led the Travellers’ Pulse research project for Destination Country and Outback NSW. Strategies and actions informed by research is a key to success for any destination, event or business. Jo has delivered research and consultancy services for local and state government agencies since 2002. With an emphasis on regional growth, Jo utilises a mixed methods approach to understand visitor motivations and perceptions – and their impact on the social and economic value to destinations. This approach is encapsulated in and underpins the credibility of the Travellers’ Pulse research program.